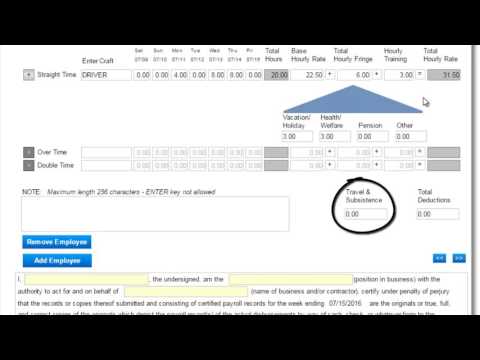

Hi, my name is Jean Marie Duvall. Welcome to the online CPR system tutorial. We will be entering payroll information in this tutorial, which is the second part of a two-part series. Let's pick up where we left off. To enter the craft for the employee under straight time, click on the plus icon if they had multiple crafts or worked split shifts with different hourly pay rates. This will allow an additional row to appear for you to enter that information. However, for our example, we will only be using one craft for our employee. To remove the additional craft, click the minus sign. Next, click on the hours and days field for your employee. In these fields, only include hours that were subject to prevailing wages for this project. As an example, let's say this employee worked eight hours on Wednesday, eight hours on Thursday, and four hours on Monday. Notice that the total hours field automatically calculates the total for you. Now, click on the base hourly rate and enter the hourly rate that was paid to this employee. Unless fringe payments are paid directly to the employee, this rate should not include fringe payments. If fringe is paid directly to the employee, include that amount in the base hourly rate and enter zero in the total hourly fringe field. Fill in the total hourly fringe field with the total amount paid to the employee. If fringe is paid to a benefit plan, enter the total amount in this field. The system will then ask for the breakdown of the total entered. Make sure to check your totals and correct any discrepancies in order to proceed. Moving on, click on the hourly training field. This is the amount paid to the Training Fund contribution. Please note that the training fund contribution...

Award-winning PDF software

Contractor Fringe Benefit Statement California Form: What You Should Know

Statement shall be completed on the same paper that is the first verified payroll. (Name), (Signature) : Date: This shall be submitted with the first printed form. Include only the following information for Schedule D: — Employer name (Name) — Employer mailing address (Street address) — Date of employment or discharge (date or number) — Expected date The first copy shall be retained as a time log. The second copy shall be destroyed if the employer wishes to discharge the employee. The first copy shall be retained in accordance with the procedures contained in the City Ordinance No. 12891, as amended, including all attachments except: — Form No.: 5-3 — Fringe Benefit Statement.SDR — Form No.: 8-3 — Form No.: 8-12 — Form No.: 8-3R — Form No.: 8-6 — Form No.: 8-6I — Form No.: 8-6II — Form No.: 8-15 All other information deemed confidential, shall be entered as information on that paper only. No other form is required to be filled in prior to submitting for approval. Expected dates of return and/or remarriage must be entered on forms. Note: No remarriage information is used. (Name), (Signature) date of birth: Date of employment shall be the date of employment. (Name), (Signature) date of birth: Date of retirement must be the date the employee retired. No other information is required to be entered on any form. (Name), (Signature) salary: Employer Payroll Number. (Employer Name) Payroll Number (Number from Form No. 5-3 or form 8-3) Date Filed: (Business day) — Employer Payroll Number (Number from Form No. 5-3, 8-6, etc.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Fringe Benefit Statement, steer clear of blunders along with furnish it in a timely manner:

How to complete any Fringe Benefit Statement online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Fringe Benefit Statement by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Fringe Benefit Statement from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Contractor Fringe Benefit Statement California form