Music. Hi, my name is Finn Presley and welcome to McDermott Tax Dates. I'm joined today by my partner Judith Ethel and we're here to talk about some of the ways that the new tax reform legislation is going to impact your employee benefit plans, specifically your fringe benefits and your health and welfare plans. Judith, start us off with the new Family Medical Leave Tax Credit. Oh, this is an exciting one, Finn. I'm really jazzed about this. This is basically money on the table for employers, and they need to be focused on this for 2018 and 2019. If you're paying any portion of wages for certain individuals who are on FMLA, you can take a tax credit. It's exciting, and I think people aren't really focused on it right now, so you want to dig down and get some more information. As I said, it's limited to certain employees. It's only employees making less than $72,000 a year, but many employers are already providing this program, so why not get the benefit? Exactly. Something else that came out of the new tax reform legislation is the repeal of the individual mandate beginning in 2019. Now, employers are interested in this, but I don't think we're gonna see a lot of changes to employee benefit plans. We may see a slight dip in enrollment of some folks deciding that they're gonna waive their health insurance beginning in 2019, but I don't think it's gonna be much of a material change. A lot of employers have also asked if that's going to mean ACA reporting goes away, and unfortunately right now, for the time being, ACA reporting is still here to stay as long as we have the employer mandate. We're still gonna have to do that 1095-C each year. That's...

Award-winning PDF software

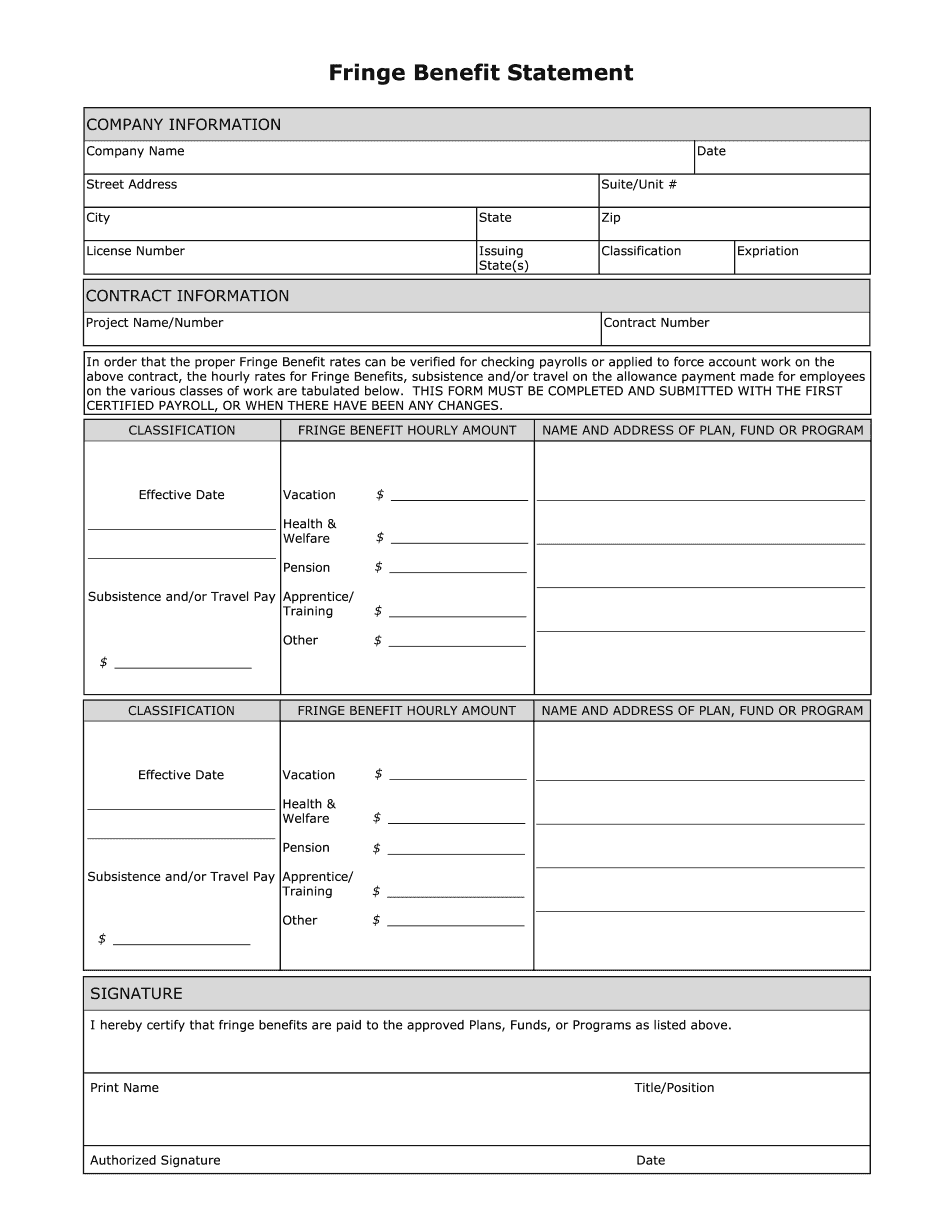

Fringe Benefit Statement nevada Form: What You Should Know

Fill Out and Sign Here.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Fringe Benefit Statement, steer clear of blunders along with furnish it in a timely manner:

How to complete any Fringe Benefit Statement online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Fringe Benefit Statement by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Fringe Benefit Statement from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Fringe Benefit Statement nevada