Can a non-profit hire employees? Many nonprofit organizations hire employees as staff to conduct programs, conduct fundraising, maintain accounting, file taxes, and provide other services. The nonprofit has the same legal obligations to its employees as any private business corporation, such as prohibitions against discrimination and harassment. The nonprofit corporation is also obligated to report employees' income and make withholdings payments to the federal and state governments. They are responsible for state unemployment insurance taxes, workers' compensation insurance, state disability insurance, payment of the employers' portion of federal Social Security, federal unemployment tax, and Medicare. The nonprofit must also comply with standard employment terms and conditions, including minimum wage, overtime, and break periods. The following forms must be filed with the federal and state government: employees' withholding certificate (W-4) and California form DE for corporation, federal quarterly withholding returns (Form 941-E), and bank deposits of withheld income taxes and Social Security taxes. Additionally, an annual federal wage and tax statement (W-2) and California employer registration form, California income tax withholding form SE, for California quarterly unemployment and disability insurance, and annual federal unemployment tax return. It is important that the nonprofit correctly classifies employees for purposes of federal and state wage and hour laws. For independent contractors, the corporation must file IRS Form 1099 and California form DE 542 if the contractors are paid more than $600. As a practicality, the nonprofit should obtain directors and officers insurance, which will protect the individuals from civil claims and employment lawsuits. An employment practices liability insurance policy covering employment-related claims may also be obtained.

Award-winning PDF software

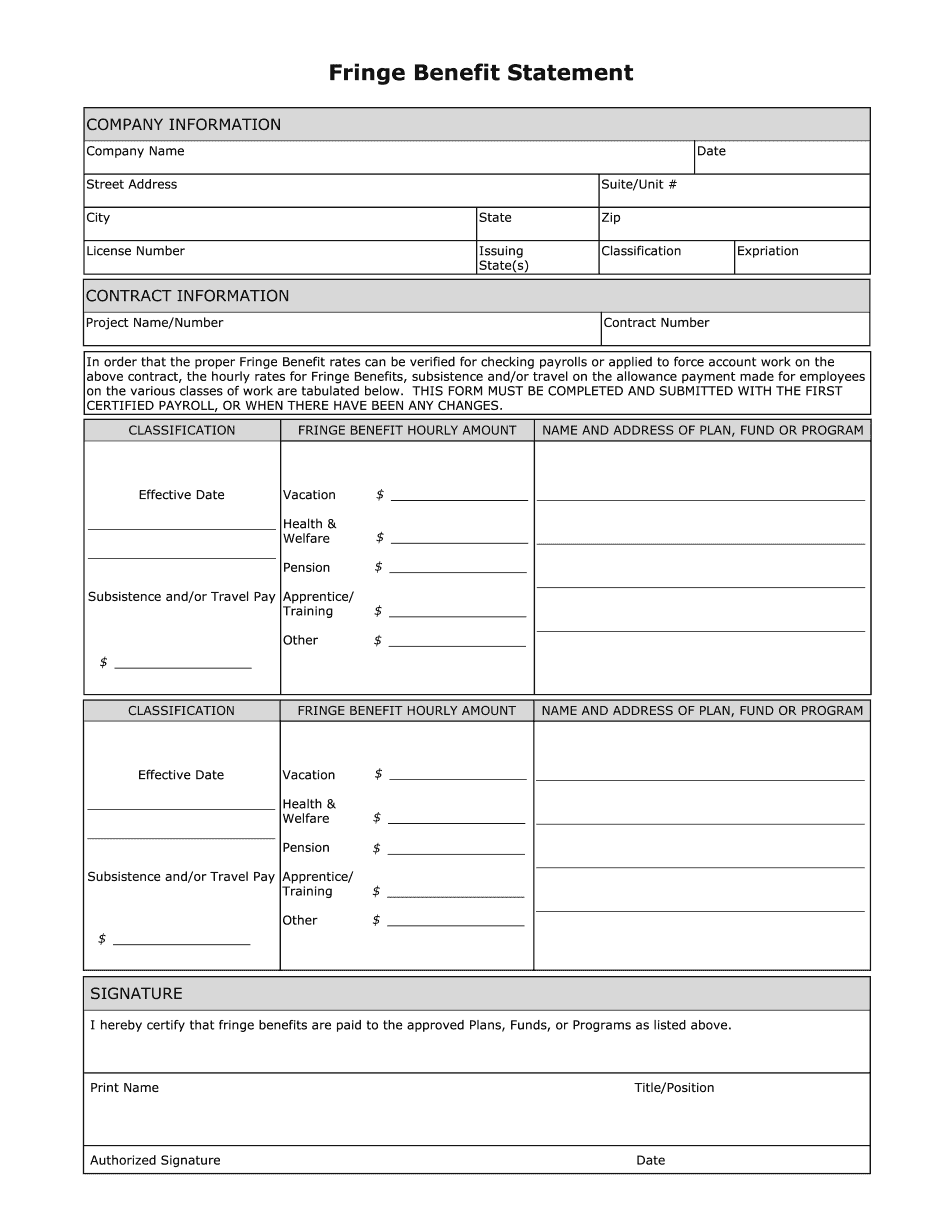

California public works Fringe Benefit Statement Form: What You Should Know

Fringe benefit rates are shown in the following table. For purposes of this application: For a Worker who is working for a State or local government that is exempt from the requirement to pay minimum wage to its workers, to have its workers provided fringe benefits, the fringe benefit rate in effect, at the beginning of the payment period for a Worker shall be: .25 for a Worker under 26 years old For anyone under 28 years old, the annual fringe benefit rate, not to exceed .75 for a Worker under 26 years old For anyone under 28 years old, the annual fringe benefit rate, not to exceed .75 For anyone under 33 years old the annual fringe benefit rate, not to exceed .90 for a Worker under 26 years old For anyone under 30 years old, the annual fringe benefit rate, not to exceed .95 for a Worker under 26 years old For anyone older than 30 years old, the annual fringe benefit rate, not to exceed .95 For an Employee who is working for a State or local government that is not exempt from minimum wage requirements, a fringe benefits payment is calculated as follows: Payroll and Wage Payments To a Person who is making more than 1,300.00 per month Payroll and Wage Payments To a worker who is making more than 5,500.00 per month. In the case of a Worker who is under 27 years old, the amount of compensation for Fiduciary Benefits (for Filing Periods) shall be calculated as follows: Payroll and Wage Payments To a Worker who is making more than 4,600.00 per month Payroll and Wage Payments To a worker who is making more than 600.00 per month. In the case of a Worker who is under 27 years old, the amount of compensation for Fiduciary Benefits (for Filing Periods) shall be calculated as follows: Payroll and Wage Payments To a Worker who is making more than 1,200.00 per month Payroll and Wage Payments To a worker who is making more than 600.00 per month. In the case of a Worker who is under 27 years old, the amount of compensation for Fiduciary Benefits (for Filing Periods) shall be calculated as follows: Payroll and Wage Payments To a Worker who is making more than 1,200.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Fringe Benefit Statement, steer clear of blunders along with furnish it in a timely manner:

How to complete any Fringe Benefit Statement online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Fringe Benefit Statement by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Fringe Benefit Statement from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing California public works Fringe Benefit Statement