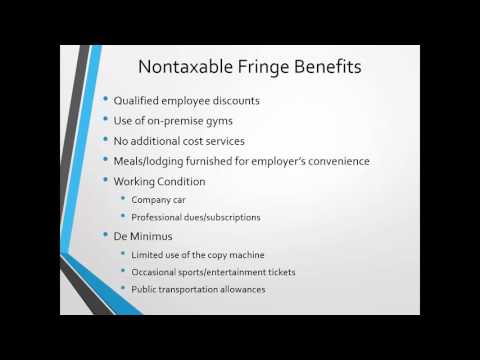

In addition to the wage, most employers will offer non-taxable fringe benefits. However, they also offer taxable French benefits. These non-taxable fringe benefits are commonly found in the workplace. Examples of these benefits include qualified employee discounts, where an employer may have a partnership with Verizon or T-Mobile, allowing employees to receive a 15% discount on their monthly cellphone bills. It is important to note that these qualified employee discounts should be offered to all employees without any discrimination towards officers, owners, or highly compensated employees. Another non-taxable fringe benefit is an on-premise gym. If the gym is operated by the employer or the owner, and the facility is mainly used by employees and their dependents, it is considered non-taxable. However, if the gym is off-premise and open to the public, like Gold's Gym, and the employer pays for the employee's membership, it becomes a taxable benefit. No additional cost services are also considered non-taxable fringe benefits. For instance, when there is an empty seat on an airplane, a stewardess can use it without costing the employer anything extra. This applies to industries where there is no additional cost for allowing employees to enjoy certain services. The taxability of fringe benefits related to meals, lodging, and furniture depends on whether they are for the employer's convenience or if they benefit the individual. When an employer sends an employee to a conference or takes a client out for lunch, these expenses are considered non-taxable because they further the pursuits of the business. Working condition and fringe benefits, such as a company car, are non-taxable as long as they are used for business purposes. Professional dues, like bar dues for attorneys or certifications for Certified Financial Planners (CFPs), are also non-taxable when they are connected to the business. Similarly, subscriptions to medical or business journals that...

Award-winning PDF software

Fringe benefits deducted from paycheck Form: What You Should Know

The tax withholding provision of section 48B will take precedence over any garnishment. Excess Contributions To Traditional or Roth Accounts | Pre-Tax & Post-Tax — ADP To establish the excess contribution deduction, the contractor must provide specific information to the Taxpayer ID Number given on Form W-4 in the year of payment. Include as a deduction in the gross wages a dollar limit (determined after deducting the excess contribution deduction) on the excess contributions from all such contributions to that person's Form W-4 for the year, in addition to the amount of tax withheld.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Fringe Benefit Statement, steer clear of blunders along with furnish it in a timely manner:

How to complete any Fringe Benefit Statement online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Fringe Benefit Statement by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Fringe Benefit Statement from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Fringe benefits deducted from paycheck