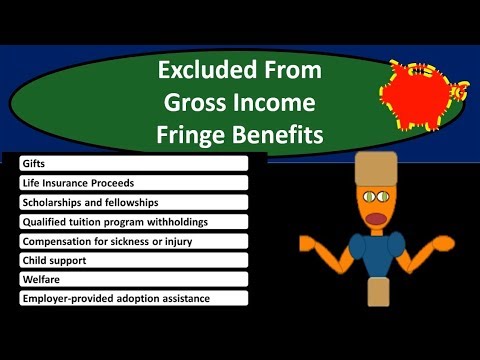

In this presentation, we will discuss fringe benefits items that we do not need to include in gross income for federal income taxes. These items are important because any time we have fringe benefits, such as those from an employer, that are not included in gross income calculations for federal income taxes, we are able to get a benefit without having to pay taxes on it. This is beneficial for both employers and employees. As an employer, if we can provide benefits to our employees that they get to keep without having to give a part of it to the government, it is advantageous. It allows us to provide more value to our employees, rather than just wages. These are some topics covered in accounting information and accounting courses. For more information, please visit our website at accountinginstruction.info. When it comes to fringe benefits, the Internal Revenue Service (IRS) has specific rules which must be followed. The government is suspicious of any payment that is not included in gross income because it is an area where people can try to take advantage. Therefore, there are rules regarding what types of things can be given and included. These rules usually revolve around either the item being small or insignificant to taxes, or the government trying to influence certain behavior by offering a tax incentive. Fringe benefits must also meet non-discrimination rules. An example of these rules is the provision of no additional cost services to an employee. For instance, if an airline has empty seats on a flight, they can offer those seats to employees without incurring any additional cost. However, if the employee takes someone else's seat or reserves a seat in advance that could have been filled by someone else, there may be added costs involved.

Award-winning PDF software

Federal Fringe Benefit Statement Form: What You Should Know

Form T-4, Statement of Account. This form can be sent to the appropriate payroll department to be faxed, by mail, or emailed The employer must notify the employee at the time of pay and at the time of submission of the Form WH-347. If applicable, the Form WH-337. Statement of Payroll Expense (T&E) must be faxed or emailed to the appropriate payroll department at the time of pay and at the time of filing the Form WH-347. Note: If there has been a change in rate of pay (e.g. termination of employment, reduction in hours), the Form WH-347 may have to be updated. Forms WH-347, WH-337 and WH-343, must be filed with the Forms W-2 and Form W-3. If a new schedule of wages, fringe benefits or tax adjustments has been made, a new Form WH-347 must be filed. The Form WH-347 must contain the information indicated in the following table. WH-347 FORM Name of Payroll Worker Name of Employer Date the Form/Payroll Record was completed Date the Form was filed Title of the Payroll Worker in Letter Field Name of Payroll Worker's Previous Employer Payroll Employee ID Number for Employee File Number and D.O.T. Serial Number Date the Form/Payroll Record was submitted Date filed Payroll Employee ID number and Payroll Employee ID number where the Form(s) was sent to Type of employee (If the employee is a full time employee) Type of employee (If the employee is a part-time employee) Name of Form(s) filed (Forms WH-347, WH-337, Form WH-343) D.O.T. Serial Number Paid during calendar year Name of Form(s) File(s) Paid by Current Payroll Worker D.O.T.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Fringe Benefit Statement, steer clear of blunders along with furnish it in a timely manner:

How to complete any Fringe Benefit Statement online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Fringe Benefit Statement by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Fringe Benefit Statement from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Federal Fringe Benefit Statement Form