Award-winning PDF software

Davis bacon wages and payroll procedures Form: What You Should Know

This Guide is not legal advice in any way. This Guide also includes the following information: The purpose of the Act is to establish a program in the form of mandatory weekly payments to certain laborer and subcontractor laborers on construction projects. The Davis-Bacon Act is enforced by the Wage and Hour Division of the U.S. Department of Labor. The requirements of the Act are incorporated by reference into the Davis-Bacon Order. See Labor Code Sections 5982(7), 6056(r). 1. The Wage and Hour Division collects wage records, pays the amount to a Wage and Hour agent and sends notice of payment upon request. The Wage and Hour Division does not file an administrative complaint. The Wage and Hour Act directs compliance with the Act with a certified payroll form. 2. The payment of the wages and wages and interest on the outstanding balance may be delayed by several months (up to 12 months) as permitted under the Davis-Bacon Act. 3. A certified payroll form is required by the Davis-Bacon and related Act. The form must be submitted with a certified statement as prescribed by the Wage and Hour Division for payments for work performed by laborers or mechanics. The statement must be signed by an authorized representative of the employee or employee's representative. An authorized representative is any person whom the employee or employee's representative has designated to sign the form, and, except as otherwise provided by local law, includes the employee. The statement must be submitted with a certified payroll form. The Wage and Hour Division does not file an administrative complaint. Labor Code Section 6056(r) requires that the statement contain the name, address and signature of the employee or the employee's representative. The statement must be submitted with a certified payroll form. Labor Code Section 6056(r) requires that the statement contain the name, address and signature of the employee or the employee's representative. A federal labor officer can waive this requirement if the person who signed the statement had knowledge that the information contained in the statement was false or misleading. 4. The Wage and Hour Division enforces the federal Davis-Bacon Act. Compliance may also be enforced by the Attorney General's Office if an act, practice or course of business is involved. 5. Payment of wages on a certified payroll form must be made within 60 days following the date of receipt of the report covering the payment of wages or within the time for filing payment notices under Labor Code Section 6056(r.

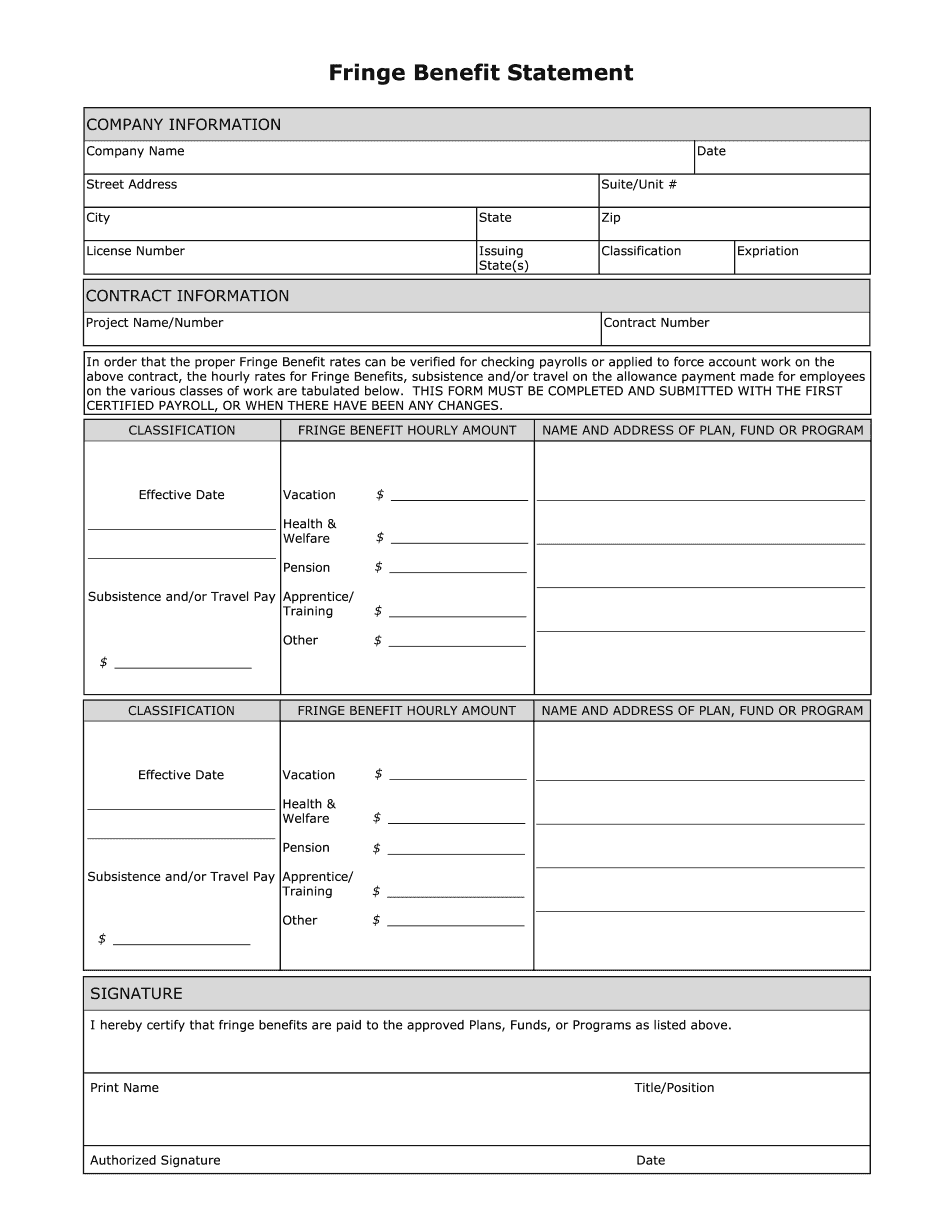

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Fringe Benefit Statement, steer clear of blunders along with furnish it in a timely manner:

How to complete any Fringe Benefit Statement online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Fringe Benefit Statement by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Fringe Benefit Statement from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.